The Merge series (part 3): MEV landscape

Part 3 of a 3 part blog post series on the Ethereum Merge. In this post, we dive into mev-boost and its adoption, the builder and relay landscapes, and what this adoption and optimization towards MEV and rewards in general mean for the network.

The analysis in this post spans from Aug 1 to Nov 15, 2022.

Maximal Extractable Value (MEV) is the maximum value outside of standard block rewards and fees that can be extracted by privileged actors in the block production process. This extraction is done mainly by changing the order of transactions, and by the exclusion and inclusion of specific transactions in a block.

Key takeaways

mev-boost block rewards (median) are 2.66x higher than locally built blocks, while the maximum difference on daily delta windows, reaching as much as 7.9x.

MEV Relays are responsible for facilitating the production of >85% of blocks on Mainnet, and the distribution of >98% of the EL rewards.

50% of all blocks in the network and almost 70% of all execution block rewards, can be traced back to just 4 builder entities.

The Flashbots relay is attracting the most submissions by the most diverse set of builders, as it is the relay that maximizes the probability of a builder getting their block picked by a proposer–with 90% of validators being subscribed to it.

Since the start of October, Eden Network’s relay has had consistently higher average block rewards than Flashbots’, driven by two builders who exclusively send their bids to the Eden Network relay. These builders produce higher value blocks than the four identified Flashbots builders.

Builder-relayer vertical integration seems the dominant strategy in terms of making a MEV Relay sustainable.

Validators running mev-boost should connect to as many relays as possible to not only counteract centralization issues but to also gain the optimal amount of execution block rewards.

MEV before and after the Merge

Pre-Merge, MEV would accrue to miners, given they were the ones responsible for block production. Specialized actors known as “searchers” would detect profitable MEV opportunities and bundle those into a set of transactions to be submitted to the network. At first, since there is no deterministic way for these transaction bundles to be included in the block by a miner, searchers would pay an exorbitant amount of gas fees in hopes of guaranteeing inclusion.

The introduction of the Flashbots Auction and mev-geth, a patch of the go-ethereum client that evaluates these bundles based on profitability, made the facilitation of this searcher-miner-MEV marketplace more efficient with as less negative impact to the network as possible.

Post-Merge, the aforementioned portion of MEV now goes to validators who are now the ones that have the responsibility of proposing blocks to the network. Searchers now submit these MEV transaction bundles to another set of actors known as “builders”. These builders specialize in building blocks optimized for block rewards. Take note that searchers can also be the builders themselves.

These blocks are then submitted to proposing validators via mev-boost, a piece of middleware that enables validators to receive these blocks from builders. Builders would send bids along with the blocks in hopes of getting their block selected by the validator for inclusion in the network.

MEV relays sit in the middle of the builders and validators to facilitate this marketplace.

mev-boost adoption

Looking at the overall number of blocks, nearly 90% of blocks in the network are mev-boost blocks. This is being driven by the adoption of mev-boost across all types of entities, from pools to home stakers alike.

Figure 1: mev-boost adoption over time

Figure 2: mev-boost adoption over time by cohort

As we established in our previous blog post, running mev-boost leads to a significant increase in execution rewards and this message seems clear to all validator cohorts. Across the board, all cohorts have at least a 70% adoption rate, with the largest (>10k validators) and the smallest (under 10 validators) being the slowest to adopt. As of more recently, the cohort with the highest network penetration, has a 92% adoption rate.

Switching the frame of reference to pools, the top five pools in terms of network penetration all have more than an 85% mev-boost adoption rate , with Coinbase ramping up from 0% to 98% of blocks produced within 11 days. This wider penetration amongst cohorts and pools alike has led to the flatlining of the share of mev-boost blocks recently albeit at a high level.

Figure 3: mev-boost adoption over time in large staking pools

The story is the same with all operators where we can see that 70% of them (29 out of 41) show at least 50% mev-boost penetration.

Figure 4: mev-boost adoption among large operators since the Merge

mev-boost vs local (vanilla) block building

We mentioned earlier that running mev-boost leads to a significant increase in execution rewards. The question then is, how much exactly? How big is this gap between mev-boost and non MEV-boost blocks and is this enough to warrant a wide adoption rate amongst all types of validator entities?

Table 1: Summary statistics of mev-boost vs vanilla block production

In terms of the median execution rewards per block over the period, mev-boost block rewards are 166% higher compared to non mev-boost blocks. One factor is the amount of transactions within blocks and true enough, mev-boost blocks also contain 40% more transactions compared to non mev-boost blocks (179 vs 125).

Figure 5: Time-series of median block rewards of mev-boost vs vanilla blocks

The difference in rewards is consistent and more stark when changing the frame of reference to daily increments. There is a 188% average difference between a mev-boost block and a non-mev-boost block per day, with the maximum difference reaching as much as 7.9x.

This difference was the most prominent from Nov 8-11 where the number of mev-boost blocks with more than 1 ETH in rewards were 10x more than the usual. Looking at the lowest daily difference, it looks like validators running mev-boost can expect at least 2x more rewards.

Unsurprisingly, there is a very strong correlation (0.93) between the number of transactions and the rewards for non mev-boost blocks. However, when looking at mev-boost blocks, this correlation drops nearly 60% to 0.40.

Figure 6: Correlations between EL rewards and tx count in mev-boost blocks vs vanilla blocks.

This intuitively makes sense. Proposers of non mev-boost blocks purely rely on the transaction fees so the more transactions are packed in a block, the more fees are generated. As for mev-boost, the rewards of proposers are driven by the bid value of the block builder which can be paid either through the priority fees in the block or directly by a transfer at the end of the block by the builder. The number of transactions do not fully drive the value of the block anymore, especially when the proposer gets paid via that end-of-block transfer. They now depend on the bids of builders.

The builder landscape

We can identify builders based on the public key they use when submitting bids and blocks to relays. Based on this identifier, we have distinguised between 78 distinct builders. This is not a lot to begin with, especially when considering the number of validators in the network.

Figure 7: Number of mev-boost blocks by builder pubkey

Perhaps even more concerning in terms of centralization is the fact that the top five have built 56% of all mev-boost blocks and are responsible for the same proportion of rewards to validators running mev-boost.

Figure 8: Block building market share (by block space distribution) among the top-5 builders (by pubkey)

Digging deeper, we can glean more insights on these builders by way of the “extra_data” field in the execution block payloads. When decoded, this can contain information regarding the affiliation of these builders.

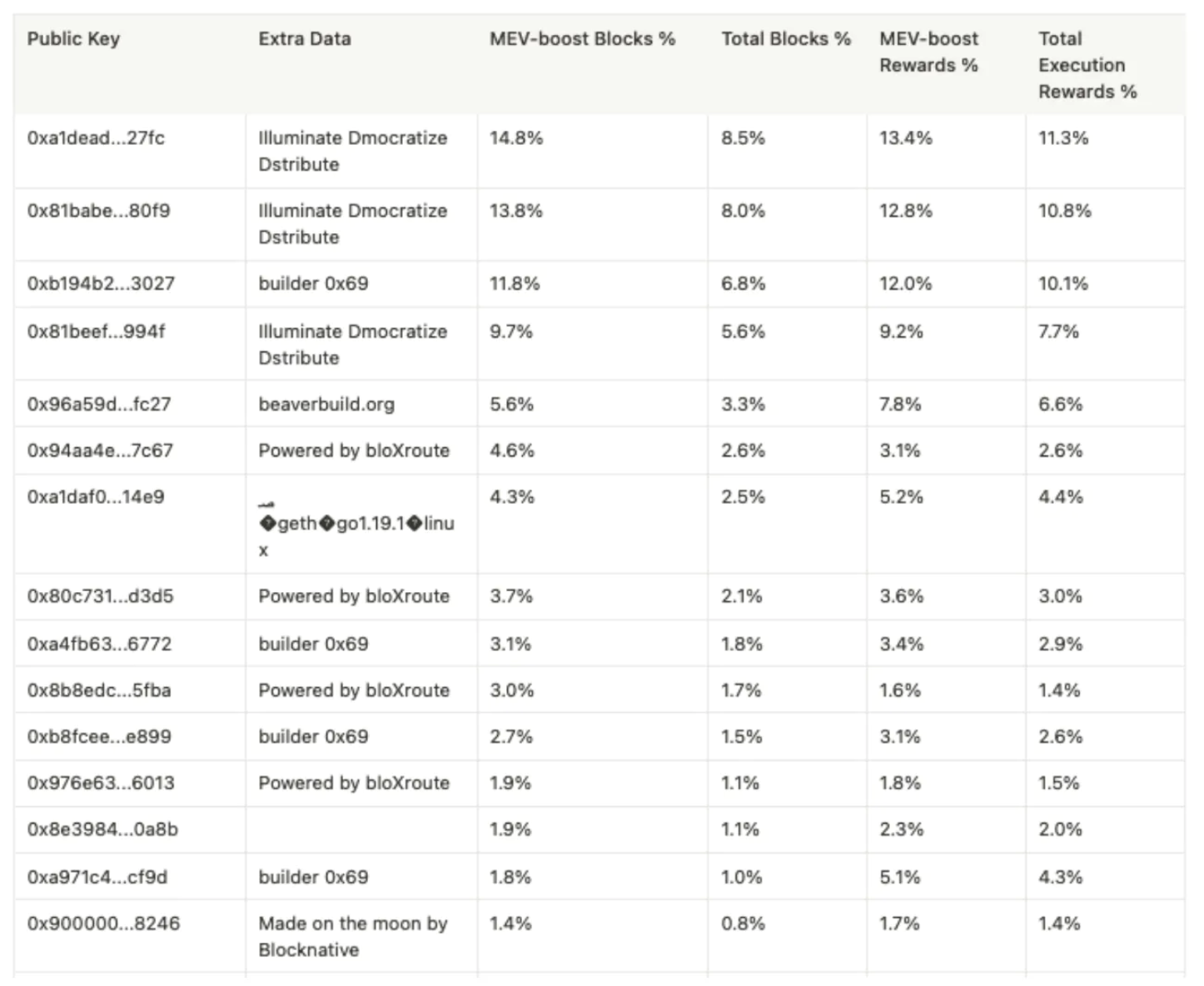

Table 2: Summary statistics and extra data fields for the top-builders by pubkey (variations of “builder 0x69” were decoded uniformly for easier presentation)

In the top 15 builders by pubkey, there are only six unique extra data inputs which we can link to different organizations. Flashbots, indicated by “Illuminate Dmocratize Dstribute”, controls three of the top five builders. Block building collective builder0x69, who runs the Relayooor MEV relay, also features prominently in the list.

Figure 9: Top 4 builder entities (identified by extra-data) market share by blockspace distribution

Figure 10: Top 4 builder entities (identified by extra-data) total rewards generated share

When we classify builders this way, we can see that there are four organizations whom we can attribute a significant majority of mev-boost blocks and execution rewards to validators as a whole: Flashbots, builder0x69, Bloxroute, and beaverbuild.org. These four have built nearly 50% of all blocks in the network and are responsible for almost 70% of all execution block rewards. Perhaps even more interesting is the fact that three out of these four are also running MEV relays. Flashbots has the Flashbots relay, Bloxroute runs three different relays, and builder0x69 is the one developing the Relayooor relay.

The question of further centralization by vertical integration then arises. This is something worth pointing out given that Flashbots and Bloxroute are also the leading relays in terms of the share of block mass.

The MEV Relay landscape

As we can see, the majority of builders submit their blocks to Flashbots. Given that this chart shows the actual blocks that make it on-chain, it looks like submitting to this relay gives builders the best chance of inclusion. Most of the smaller builders (<50 blocks per builder) also tend to submit their blocks to Flashbots because of this.

Figure 11: Distribution of builder entities (grouped together by the extra-data identifier) and relay pairs.

Top builders like builder0x69 and Bloxroute and also submit their blocks to this relay. More interestingly despite builder0x69 also submitting blocks to their own relay (Relayooor), 90%+ of their inclusions on-chain have been via the Flashbots relay, given only a small percentage of validators are registered with the Relayooor relay (as of Nov 15, 2022).

Looking at the daily market share in terms of block mass, the dominance of the Flashbots relay is very obvious. Their market share has not gone below 70% in terms of the overall mev-boost blocks.

Figure 12: MEV Relay market share over time

On average, the Flashbots relay has been responsible for 65% of all execution rewards on a daily basis (both mev-boost and non mev-boost). The next highest relay (or set of relays) in this regard is Bloxroute which runs three separate relays but only managed to have 6.9% of the execution rewards share.

We can probably attribute a portion of this to network effects. Given how the Flashbots relay has 90% of all validators registered with it, builders are more likely to send blocks to this relay for the highest probability of inclusion. As more builders compete within this relay, more validators will choose to register with the relay as the bids become higher due to competition, creating a flywheel supply and demand.

Does this mean that if validators want to optimize for maximum rewards that they should only connect to the Flashbots relay and leave it at that? Not necessarily.

Table 3: Relay summary statistics, ranked by median EL + CL rewards

As we can see, Eden Network’s relay actually has the highest median execution rewards level amongst all relays. Since the start of October, Eden Network’s relay has had consistently higher average block rewards than Flashbots’.

Figure 14: Eden vs Flashbots relay EL rewards time-series

This particular advantage by the Eden Network relay does not seem to be caused by a difference in the proportional volume of bids received by both relays nor the bid values. Their profiles are quite similar in this regard and in fact, Flashbots receives more bids per slot than any other relay.

Figure 15: Distributions of bid value and number of bids received per slot for Eden and Flashbots relays

This looks to be caused by two builders who exclusively send their bids to the Eden Network relay. These builders produce higher value blocks than the four identified Flashbots builders.

With data so far since the Merge, it looks like the optimal strategy for relays and builders alike is to vertically integrate to gain market share. We have seen how the Flashbots relay was able to dominate market share not only via their reputation but also through their prolific builder line up. Eden Network is also gaining traction with their (seemingly) exclusive builders producing higher value blocks. Lastly, even top builder builder0x69 that started out sending out blocks exclusively to the Flashbots relay is now managing the Relayooor relay.

With the recent move by Flashbots to open-source their relay, we can perhaps expect more competitive builders to arise, and other relay teams to build or improve upon their current builder line up.

Looking to the future

While this builder-relay vertical integration points towards centralization at the block building level, this is not necessarily the case at the wider network level. Again, Flashbots having open-sourced their builders could help in decentralizing the builder landscape but it remains to be seen if this can counter the current builder-relay vertical integration.

Regardless, even if validators optimize towards maximum execution rewards by running mev-boost, they can still connect to as many relays as possible to guarantee that they will get the highest rewards. The Flashbots relay can ensure the widest coverage but the Eden Network relay has proven to consistently have the higher valued blocks despite the relatively smaller sample size. The Relayooor relay is also gaining traction and has the backing of top building organization builder0x69. Even Bloxroute’s builders send their blocks to other relays to increase their inclusion chances.

The incentives are quite aligned at this point: validators running mev-boost should connect to as many relays as possible to not only counteract centralization issues but to also gain the optimal amount of execution block rewards.